Alpha Research Platform

powered by Predictive Technology

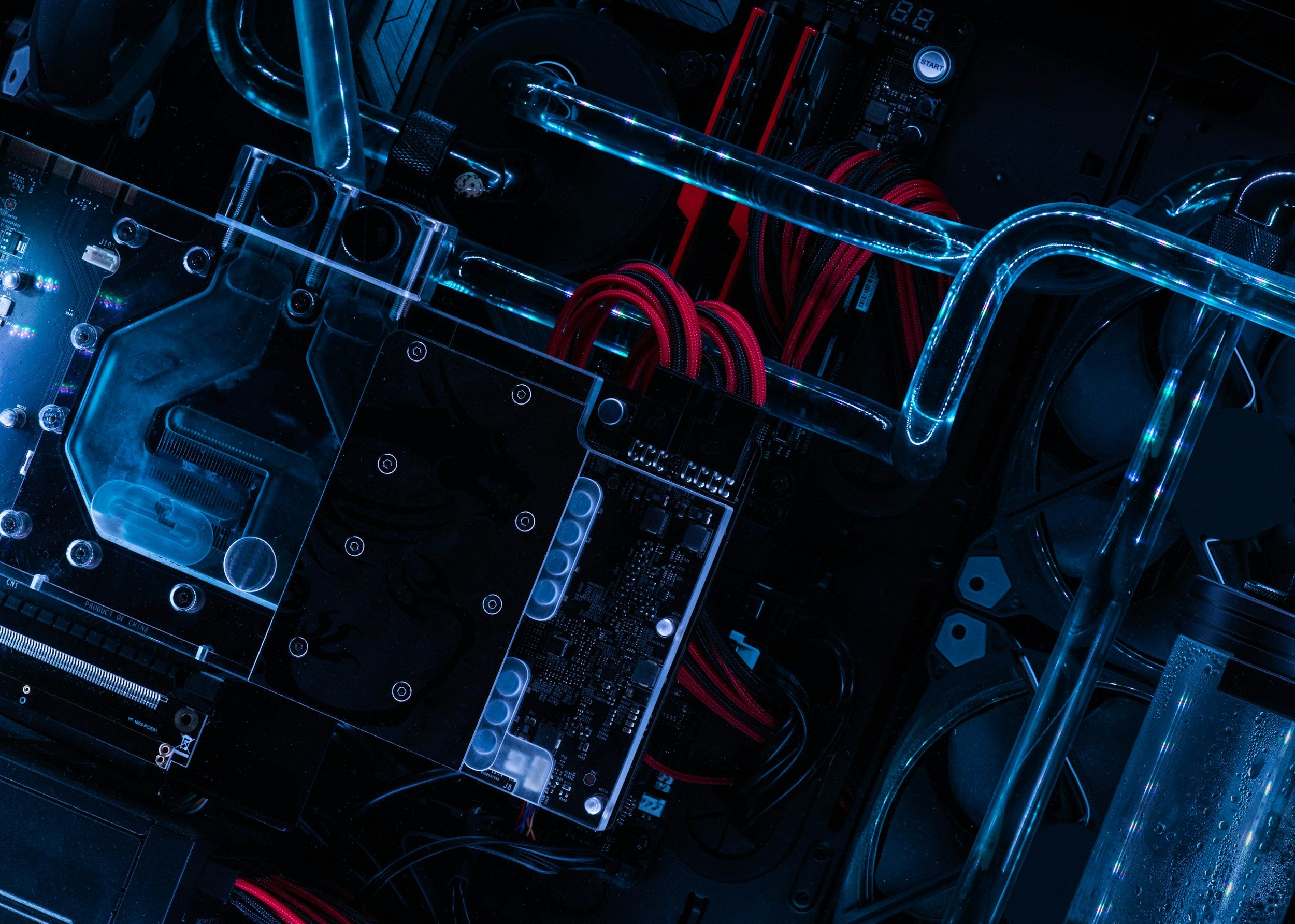

Driven by predictive technology, our Alpha Research Platform provides cutting-edge tools for data-driven decision-making based on diverse data sources.

Transforming Investing with AI

Founded in January 2016, QRAFT Technologies employs around 90 experts and offers pioneering AI-driven investment solutions across various financial products, including AI ETFs, AI model portfolios, LLM Solutions, Trading Solutions, and more. These products are underpinned by an Alpha Research Platform utilizing predictive technology.

- 1 -

Harnessing the Power of Diverse Data Sources

Unstructured data, which constitutes 90% of all available information, presents significant challenges due to its complexity. Our proprietary LLM technology automates the processing of this data, capturing nuanced contexts to enhance our investment strategies and uncover hidden trends.

By integrating these diverse data streams, we uncover hidden patterns and trends that traditional analysis might miss, leading to more informed and potentially lucrative investment decisions.

- 2 -

Uncovering Alpha:

AI-Powered Alpha Research Platform

Our Alpha Research Platform harnesses advanced machine learning algorithms to mitigate risks, adapt to market dynamics, enhance predictive capabilities, and generate diverse investment strategies. By continuously evolving our strategies, we stay ahead of market trends and capitalize on emerging opportunities.

This cutting-edge approach allows us to:

- 3 -

Trading Edge:

AI-Optimized Trading Execution

Building on our research platform, our execution engine leverages cutting-edge reinforcement learning algorithms to minimize market impact and transaction costs, optimize trading mining and sizing, and adapt in real-time to changing market conditions. This sophisticated AI-driven strategy decodes the behavior of market participants in real-time, navigating both structured and unstructured data at the most granular level.

Key benefits of our AI-optimized execution include enhanced liquidity management, reduced slippage in large orders, improved overall portfolio performance, and the ability to navigate complex, high-frequency market environments.

Proven in practice, it has won first place in NVIDIA-sponsored competitions, demonstrating its effectiveness in minimizing market impact and transaction costs.